Tax Planning Consultancy Services by CA Anshit Gupta – Maximize Savings, Stay Compliant

In the complex world of taxation, where rules are constantly evolving, smart tax planning isn’t just an option—it’s a necessity. Tax Planning Consultancy Whether you are a salaried individual, a business owner, or a high-net-worth individual, proper tax planning can make a significant difference in your financial well-being. This is where CA Anshit Gupta, a trusted name in the field of taxation and financial advisory, steps in with expert Tax Planning Consultancy Services designed to reduce tax liabilities while ensuring full compliance with Indian tax laws. Tax Planning Consultancy

Backed by years of experience and a deep understanding of the Income Tax Act, CA Anshit Gupta offers personalized tax planning solutions to individuals, businesses, startups, and corporates. Our objective is simple: to help you retain more of what you earn while staying well within the legal framework. Tax Planning Consultancy

What is Tax Planning?

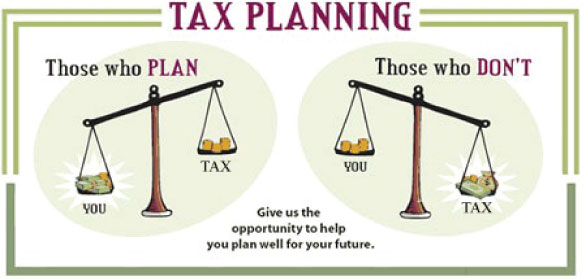

Tax planning refers to the strategic analysis and arrangement of one’s financial affairs to minimize tax liability. It involves utilizing available exemptions, deductions, rebates, and incentives in a manner that reduces the amount of tax paid. Tax Planning Consultancy

Proper tax planning is not tax evasion or avoidance—it is a legal and ethical way to ensure you are not overpaying your taxes. Effective tax planning must begin at the start of a financial year and should be aligned with both short-term and long-term financial goals. Tax Planning Consultancy

Why You Need Tax Planning Consultancy Services

Many individuals and business owners either underestimate or overlook the importance of structured tax planning. This can lead to overpayment of taxes, missed deductions, penalties, and unnecessary financial stress. Here’s why hiring a tax expert like CA Anshit Gupta can be a game changer:

- Reduce Tax Liability: Identify legitimate ways to save taxes through exemptions and deductions.

- Avoid Legal Complications: Ensure full compliance with the Income Tax Act, 1961.

- Financial Clarity: Understand your tax obligations and plan expenses/investments accordingly. Tax Planning Consultancy

- Stress-Free Filing: No last-minute rush or errors during tax return filing.

- Business Efficiency: Optimize business structure and transactions to reduce tax outflow.

- Audit Support: Be prepared for scrutiny and audits by the tax department.

Services Offered Under Tax Planning Consultancy by CA Anshit Gupta

1. Individual Tax Planning

Whether you are a salaried professional, freelancer, or self-employed, personalized tax planning is essential. We offer:

- Customized tax-saving strategies

- Calculation of tax liability

- Investment guidance (80C, 80D, 80G, etc.)

- Capital gains tax planning

- HRA, LTA, and other allowance management

- Preparation of Income Tax Returns (ITR)

- Tax savings through insurance, PPF, NPS, ELSS, etc.

2. Corporate & Business Tax Planning Consultancy

Businesses have unique tax structures that require specialized attention. Our business tax consultancy includes:

- Strategic planning to minimize tax burden

- Tax computation & quarterly advance tax support

- Proper classification of business expenditure

- GST implications & planning

- Tax benefits under Startup India Scheme

- Depreciation planning under Income Tax Act

- Tax audits and filing support

- Assistance in statutory compliance

3. Capital Gains Tax Consultancy

Managing gains from the sale of property, shares, mutual funds, or other assets? CA Anshit Gupta provides:

- Calculation of short-term and long-term capital gains

- Exemptions under Sections 54, 54EC, 54F

- Capital gain account scheme assistance

- Investment planning to avoid or reduce capital gain tax

- Support in reporting capital gains in ITRs

4. Tax Planning Consultancy for NRIs

Non-Resident Indians face dual taxation concerns and reporting obligations. We help NRIs with:

- Residential status determination

- Taxation on income earned in India

- DTAA (Double Taxation Avoidance Agreement) guidance

- Repatriation of funds & FEMA compliance

- NRO/NRE account taxation

- Tax filing for NRIs

5. Tax Planning Consultancy for Startups and MSMEs

New-age entrepreneurs need proactive tax planning from day one. Our startup-focused services include:

- Business entity structuring (proprietorship, LLP, Pvt Ltd)

- Startup India and Section 80IAC benefits

- Angel tax exemption

- Tax planning on initial funding & investments

- R&D and capital expenditure tax benefits

6. Tax Planning Consultancy for High Net-Worth Individuals (HNIs)

HNIs require more detailed financial planning and tax optimization strategies. Our services cover:

- Inheritance tax planning

- Family trust formation & taxation

- Wealth transfer strategies

- Tax-efficient investments

- Foreign income reporting and compliance

7. Advance Tax Estimation & Planning

Avoid interest under Sections 234B and 234C by paying accurate advance tax on time. We assist with:

- Advance tax liability estimation

- Timeline planning (June, Sept, Dec, March)

- Cash flow-based planning for professionals & businesses

Key Tax Planning Strategies We Use

CA Anshit Gupta adopts a combination of modern and time-tested strategies to optimize tax liability:

- Proper utilization of all tax-saving sections (80C, 80D, 80E, 24(b), etc.)

- Structuring salary components for maximum tax benefit

- Tax-efficient investment planning

- Tax benefits for housing loans, education loans

- Dividend vs. salary strategies for company directors

- Timing capital gains to reduce tax impact

- Setting off & carrying forward losses

- Choosing the right tax regime – Old vs. New

Why Choose CA Anshit Gupta for Tax Planning Consultancy?

✅ Expertise & Experience

With deep knowledge of the Indian taxation system and years of experience, CA Anshit Gupta offers reliable and up-to-date tax advisory services across all industries and income groups.

✅ Tailored Tax Planning

Every client’s financial situation is different. We create custom tax strategies aligned with your short- and long-term goals.

✅ Comprehensive Financial Guidance

From filing returns to long-term financial planning, we serve as your one-stop solution for all tax and financial matters.

✅ End-to-End Compliance

We ensure that all your filings, documentation, and audit support are handled in compliance with the latest laws and regulations.

✅ Client-Centric Approach

Our approach is focused on maximum savings and minimum hassle. We believe in educating our clients, not just serving them.

Industries We Serve

- IT & Tech Startups

- Real Estate & Construction

- Medical & Healthcare Professionals

- Freelancers & Influencers

- Traders & Manufacturers

- Educational Institutions

- NGOs & Trusts

- E-commerce & Online Sellers

Client Testimonials

Mr. Arjun Verma (Startup Founder)

“CA Anshit Gupta helped structure my company and plan our tax from day one. We’ve saved lakhs annually and stayed 100% compliant.”

Mrs. Meenakshi Sharma (IT Professional)

“I always found tax filing confusing, but with CA Anshit Gupta, it has become easy and clear. Highly recommended for salaried professionals!”

Get Started Today: Book Your Tax Planning Consultancy

If you’re looking to reduce your tax burden, avoid legal issues, and optimize your finances, it’s time to consult with CA Anshit Gupta. Whether it’s a one-time consultation or a year-round advisory plan, we’ve got you covered.

📞 Call Now: +91-093102 81781

📧 Email: ans.agg.online@gmail.com

🌐 Website: https://ashokanshit.com

📍 Location: A, 4, Moti Lal Nehru Marg, Pocket A, Nehru Nagar II, Nehru Nagar, Ghaziabad, Uttar Pradesh 201001

Frequently Asked Questions (FAQs)

Q1. Is Tax Planning Consultancy legal?

✅ Yes, tax planning is 100% legal if done within the framework of the Income Tax Act, 1961.

Q2. What documents do I need for tax planning consultation?

PAN, Aadhaar, Form 16, income details, investment proofs, and any business-related documents.

Q3. Can I shift from the new regime to the old regime?

Yes, individuals without business income can switch every year.

Q4. Do salaried employees need tax planning?

Absolutely. Salary structure optimization and investment planning can help reduce TDS and tax liability.

Conclusion: Secure Your Wealth with Strategic Tax Planning Consultancy

Don’t let taxes eat into your hard-earned income. With professional guidance from CA Anshit Gupta, you can manage your finances better, save taxes legally, and achieve your financial goals without stress.

Let us take care of the taxes, so you can focus on what matters most—growing your income and securing your future.